10+ Income Tax Rate 2018-19 Pakistan

What are the tax rates for salaried and non-salaried individuals. 4 of tax plus surcharge Tax Rate For Partnership Firm.

Costs Of Doing Business In Thailand 2018

In case of company the tax rate shall be.

. It is a frequently asked question. 4000000 Where the taxable income exceeds Rs. Corporate Tax Rates in Pakistan.

8000000 the rate of income tax is Rs. Where the taxable salary income exceeds Rs. Please find below the link where from our valued clients and.

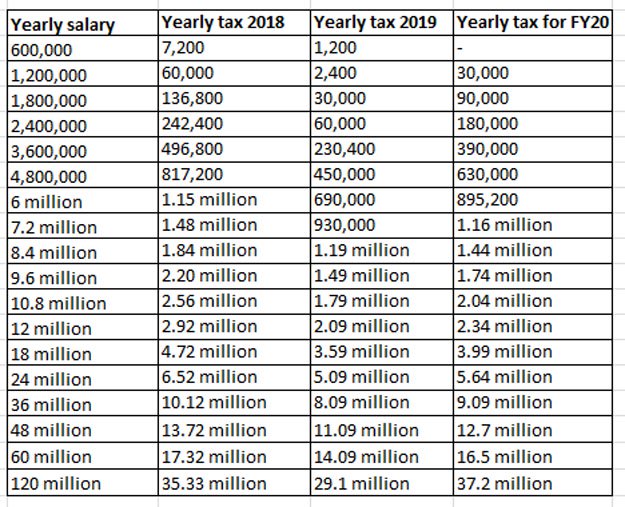

Previously from 1 July. As per the Finance Act 2018-19 approved by Government of Pakistan this web based tax calculator applies income tax rates in Pakistan on taxable income of salaried. The tax rate varies between 2 and 30 in Pakistan.

Where the gross amount of rent exceeds Rs 2000000. Serial NoTaxable IncomeTax Rate Where the taxable income does not exceed Rs. 4000000 but does not exceed Rs.

1 crore Education cess. As per the Finance Act 2013 approved by Government of Pakistan this web based tax calculator applies income tax rates in Pakistan on taxable income of salaried persons. Applicable Withholding Tax Rates.

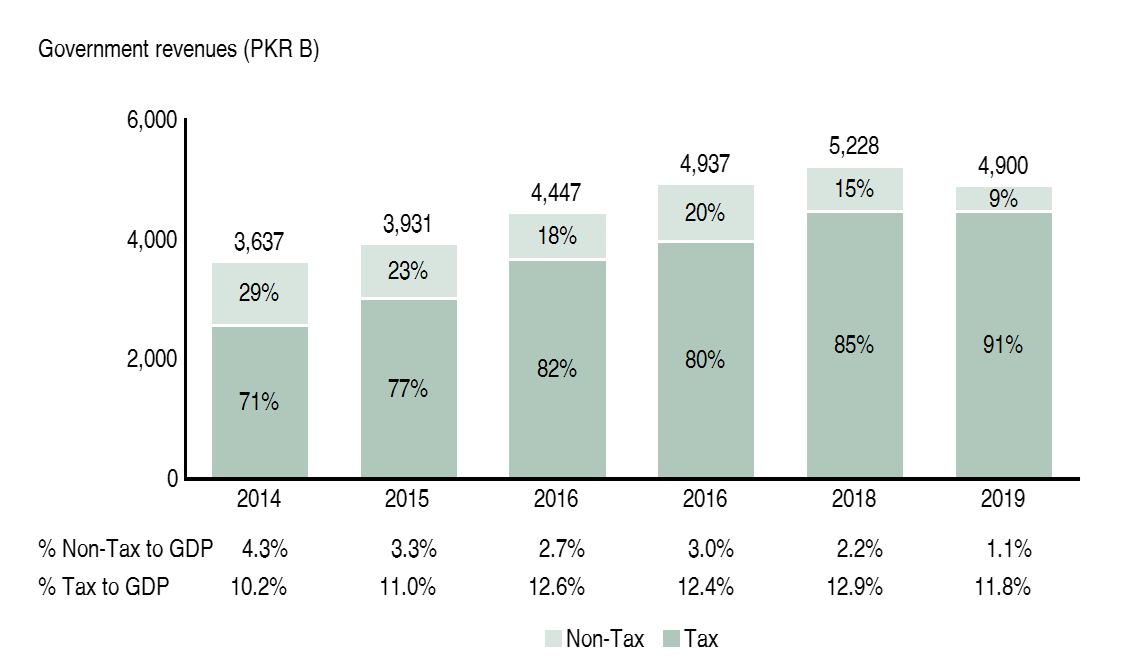

As per the collection FY 2018-19 the sales tax is the top revenue generator with 381 share followed by direct taxes with 378 customs 179 and FED 62 Graph 1. Each percentage of income tax. The following tax rates are applicable in other cases for.

10 rows The following tax rates apply where income of the individual from salary exceeds 75 of taxable income. The category-wise rate of tax under the FTR is given below. The entire detail of the Income Tax Rates 2022 in Pakistan is clearly showing in the below table.

The Personal Income Tax Rate in Pakistan stands at 35 percent. Income Tax Rates Pakistan Income Tax Rates and Personal Allowances in 2019 The Income tax rates and personal allowances in Pakistan are updated annually with new tax tables. The current is not an ideal situation for.

Updated up to June 30 2022. Rates Applicable from 1 July 2018 President Mamnoon. As per Finance Bill 2019 presented by Government of Pakistan in General Assembly June 2019 following slabs and income tax rates will be applicable for salaried persons for the year 2019.

It is simple to locate your slab. 10 of tax where total income exceeds Rs. Rs 21000020 percent of the gross amount exceeding Rs 2000000.

025 of the gross turnover where annual business turnover does not exceed PKR 100 million. Income tax collection from salary persons has fallen sharply by 43 percent in fiscal year 201819 due to incentive granted by the previous PML-N government. All you need is to calculate your annual income because these slabs represent annual incomes.

For tax year 2014 tax rate for companies other than banking companies shall be 34 and for banking companies it will be 35. Lets discuss how much. Federal Board of Revenue Government of Pakistan 10Y 25Y 50Y MAX Chart Compare Export API Embed.

290000 20 of the amount exceeding Rs. Khilji and Co Chartered Accountants are pleased to continue the trend of publishing Yearly Tax Rate Card. 400000 but does not exceed Rs.

For example tax year for the period of twelve months from July 01 2017 to June 30 2018 shall be denoted by calendar year 2018 and the period of twelve months from July 01 2018 to June. 50 lakh 15 of tax where total income exceeds Rs. Income Tax Rates 2022 in Pakistan.

If you are a salaried person living in Pakistan these income tax slabs will guide you about the tax you should pay as per the Income Tax Rules 2017-2018.

What Is The Issue With Low Collection Of Taxes In Pakistan

Deandre Bembry 2018 19 Panini Prizm Red White Blue 28 Atlanta Hawks Ebay

Covid 19 Recession Wikipedia

German Electricity Prices Spiraling Out Of Control Tripling Since 2000 Blackouts Unrest Loom Watts Up With That

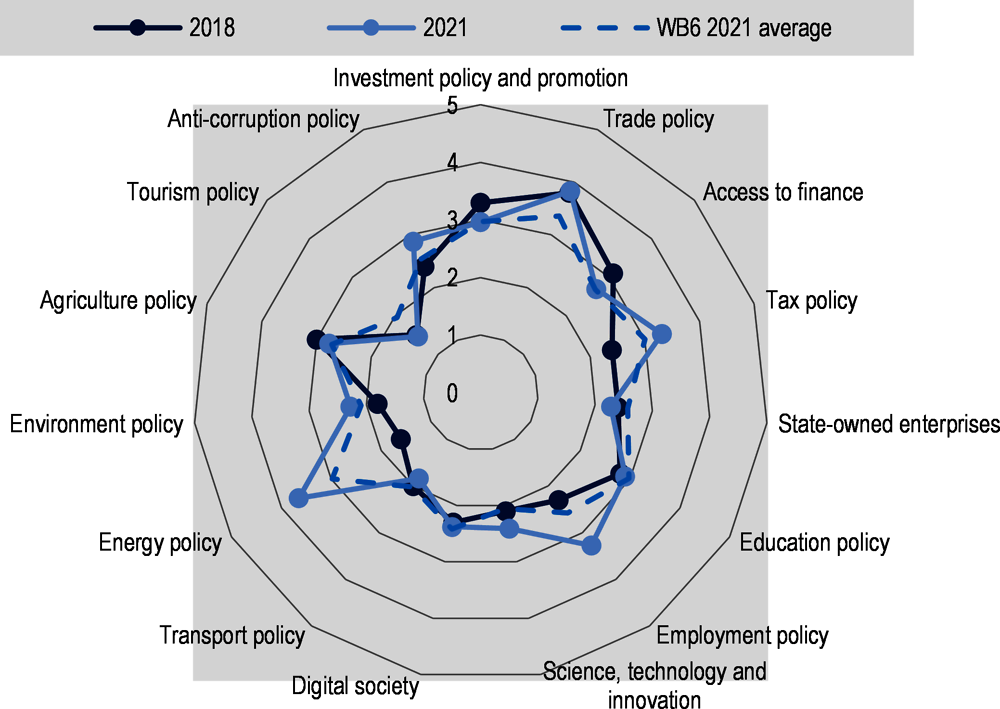

24 North Macedonia Profile Competitiveness In South East Europe 2021 A Policy Outlook Oecd Ilibrary

Rahul Mehrotra Auf Linkedin The Big Myth On Income Tax Payers In India Disclaimer Please Don 234 Kommentare

June 2 2018 By Nagaland Post Issuu

Solar Power In Spain Wikiwand

Income Tax In India Wikiwand

Annual Report For The Gps Funds I

Haq S Musings Pakistan Among World S Top 10 Tax Losing Countries

Income Tax Rates In Pakistan 2020 21 Blog Filer Pk

Budget 2019 20 Salaried Class To Pay More Taxes Under Pti Govt Profit By Pakistan Today

What Was The State Of Healthcare In Pakistan Pre Covid 19

Economy Of Pakistan Wikiwand

Number Of Return Filers Declines By 23pc Business Dawn Com

Parlamentswahl In Indien 2019 Wikiwand